After the initial discussions, the team wanted to find out more information about the users. A few assumptions were made:

- Users have different goals (e.g. weight loss, muscle gain, healthy lifestyle).

- Some users have to work around dietary restrictions (e.g. diabetics, coeliacs, allergic users, vegetarians, vegans, etc.)

- Health and Fitness apps require the user to input data for them to work.

Different challenges were foreseen while gathering user information. People can be sensitive to talk about their weight; it’s essential to build a trust relationship with the interviewees. Another consideration is that users might have different behaviour from their attitudes, making triangulation of the pieces of information crucial to this project.

The information void

A series of questions were put together to remove the obstacles that users of health & fitness apps encounter in their interactions. What are the apps that they are using and what are the challenges they are facing? Who is the new design for, where and when will it be used? What are the users’ goals? What motivates them to use these apps? The information gathered during this process will help construct the Persona later in this project.

To get answers, a questionnaire was created using a tool called Typeform. The goal was to gather data from at least hundred users that use health & fitness apps. The questionnaire (Annex 1) was sent through social networks. Because the questionnaires were shared within team member’s circles, the data gathered can be skewed. Eventually, 180 questionnaires were collected, 132 of them being from people who are currently using health & fitness apps.

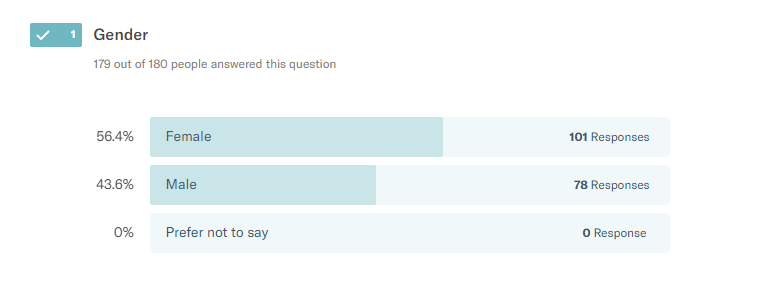

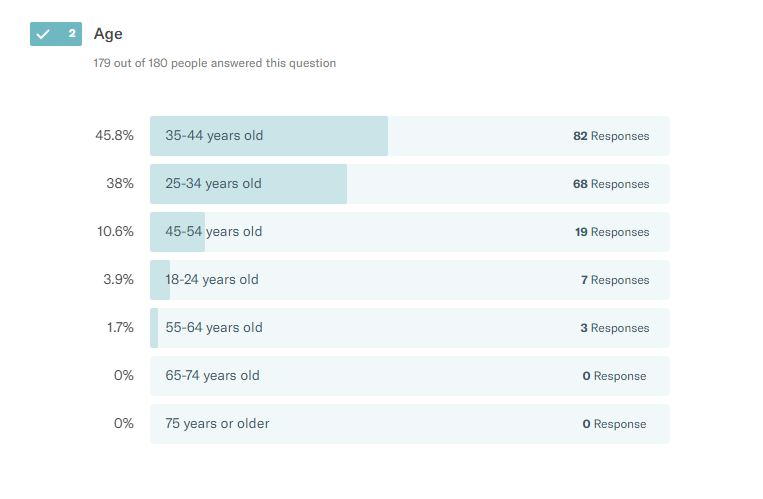

From the 180 participants in this questionnaire, 56% were female (Fig. 1). The most significant age group was situated between 35 – 44 years old with 45 people (Fig. 2). Even considering only participants using some health & fitness apps at some stage, the largest age group is still the same.

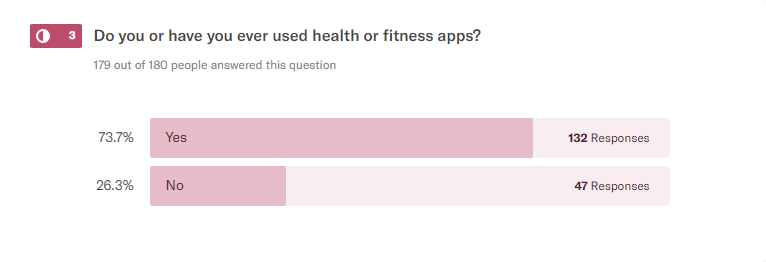

Nearly 74% of the participants used some health & fitness apps or sites at some stage (Fig. 3) with a higher percentage of women using these tools, 60.3% against 39.7% for the male counterpart.

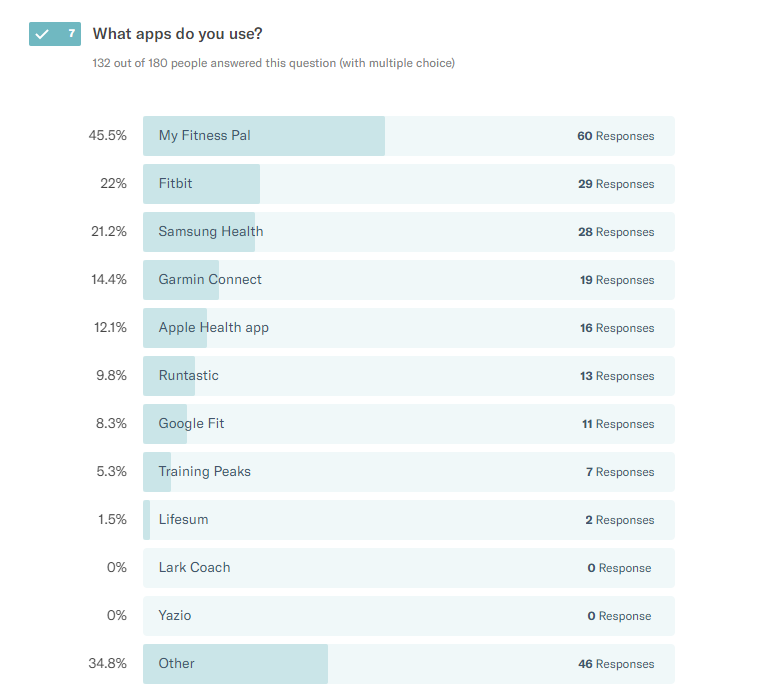

The most popular app (Fig. 4) is MyFitnessPal with 45.5%. A variety of apps showed up that we did not identify at first. An in-depth analysis of the competition will be done in a later post.

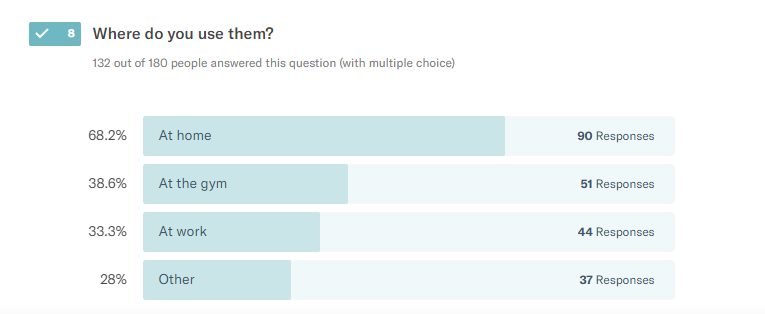

The participants use health & fitness apps at home (68.2%), gym (38.6%) and work (33.3%) (Fig. 5). Other users responded they use it during training. These individuals use apps more focused on tracking progress and performance (e.g. MapMyRun, Garmin Connect, Runtastic and Strava).

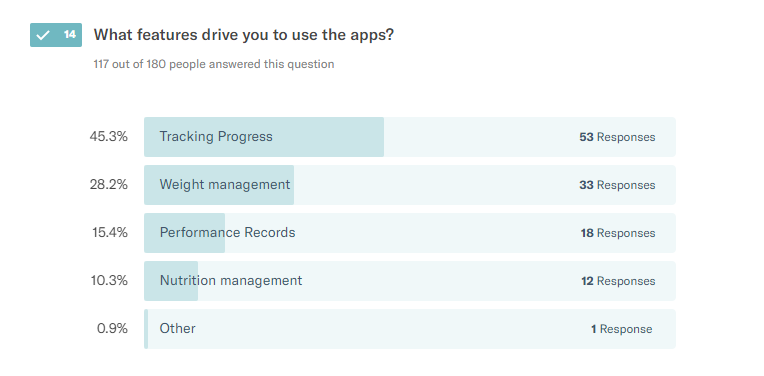

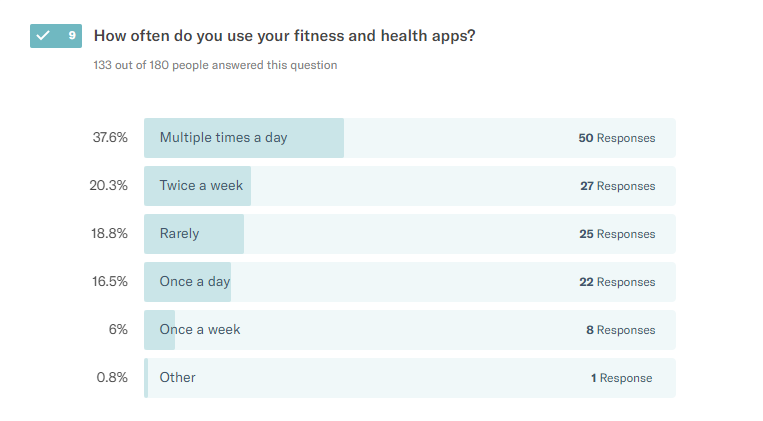

The questionnaire responses showed that users have different goals (Fig. 6): tracking progress (45.3%), weight management (28.2%), performance records (15.4%) and nutrition management (10.3%). Meanwhile, the goals of MyFitnessPal’s users are weight management (30%), track progress (30%) and nutrition management (11.6%). When asked about frequency of use (Fig. 7), 37.6% of the participants replied that they use the app multiple times a day.

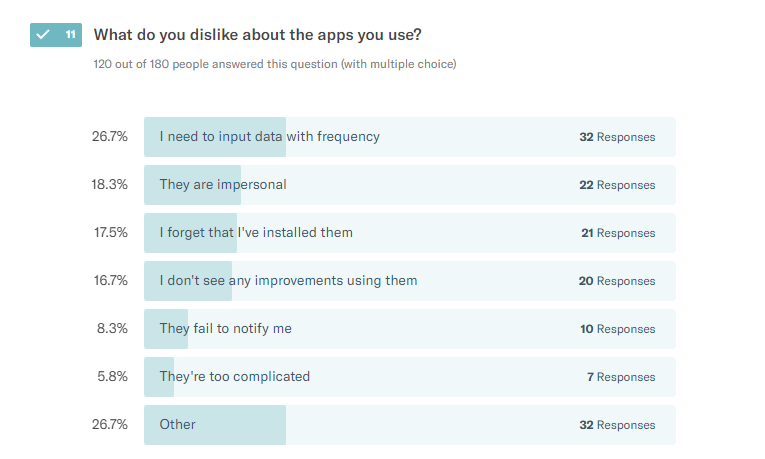

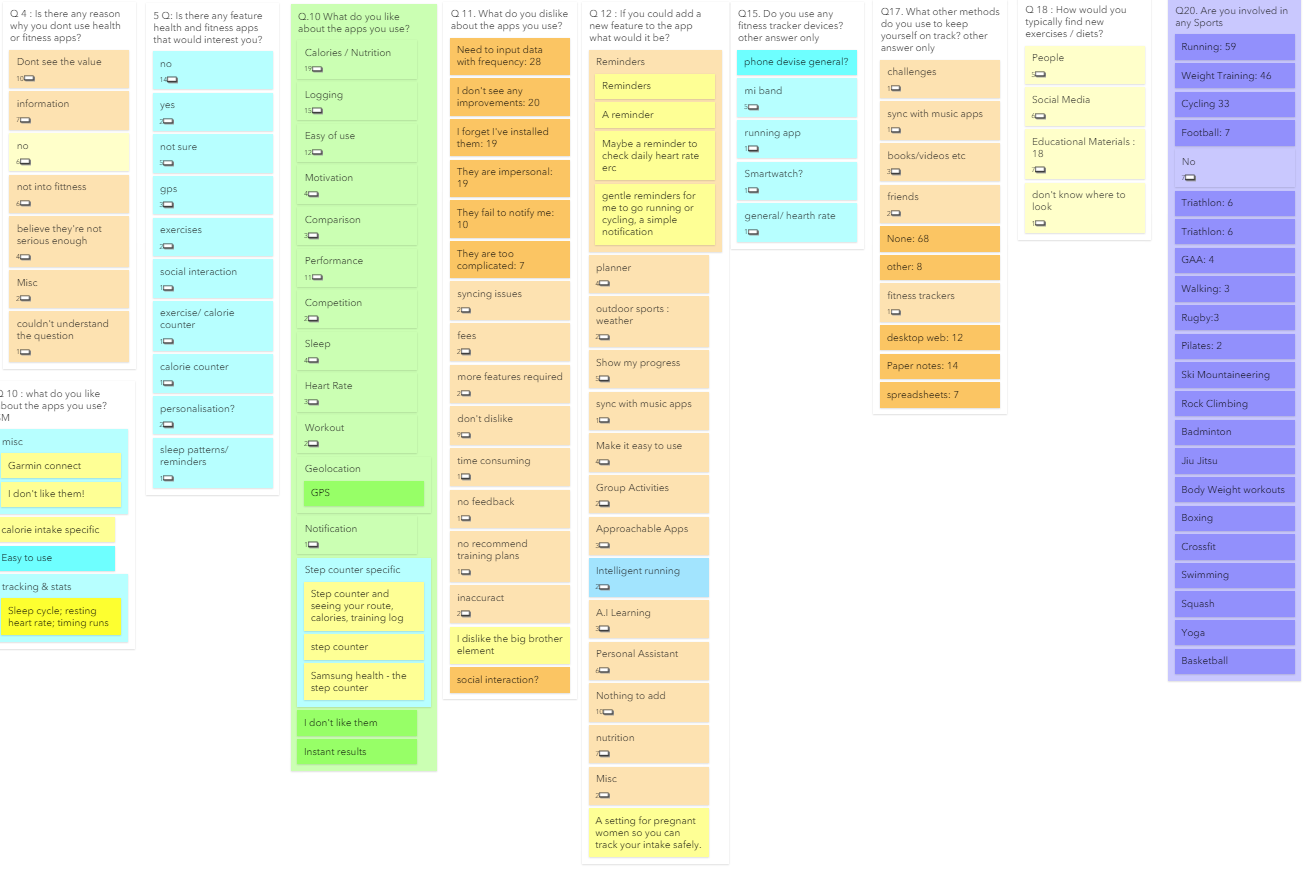

When asked about what the users dislike about the apps they use (Fig. 8), they were unhappy with the frequency they need to input data (26.7%) and that they felt that apps are impersonal (18.3%). People also responded that they forgot they had installed them (17.5%) and that they don’t see any improvements using them (16.7%).

The participants were asked what they like in the apps they use with an open question. After grouping the themes that emerged (Fig. 9), we discovered that the participants wanted ease of use, with simple and nice visuals. They also liked tracking information like calories burned, sleep tracking and distance walked without much interaction with the app. Users of apps focused on running and exercises liked features related to them: GPS tracking, distance measurement and timers.

The features they would like to have on the apps varied a lot; there was no consensus, but some desired features appeared more frequently:

- chat feature / AI bot / chatbot

- easier input options

- keep users motivated

- copying meals from one day to another

- food displayed based on user’s location

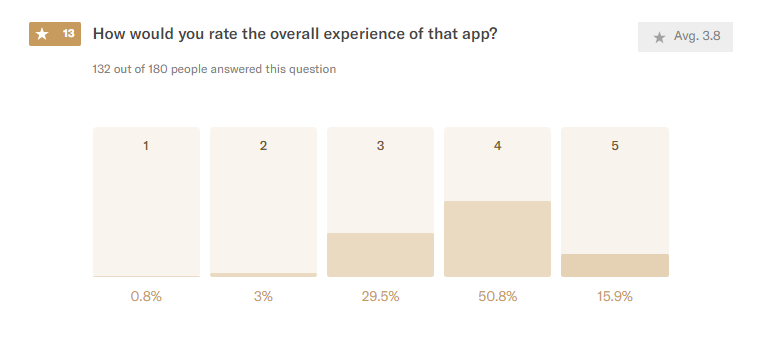

MyFitnessPal’s users rated their experience 3.8 (Fig. 10) on a scale where 1 would be a bad experience, and 5 would be considered a very good experience.

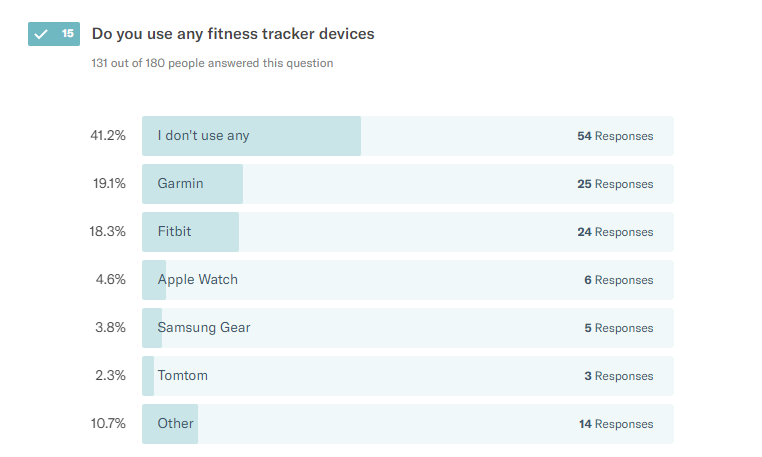

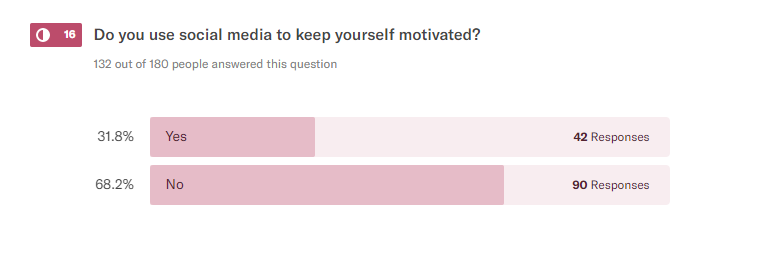

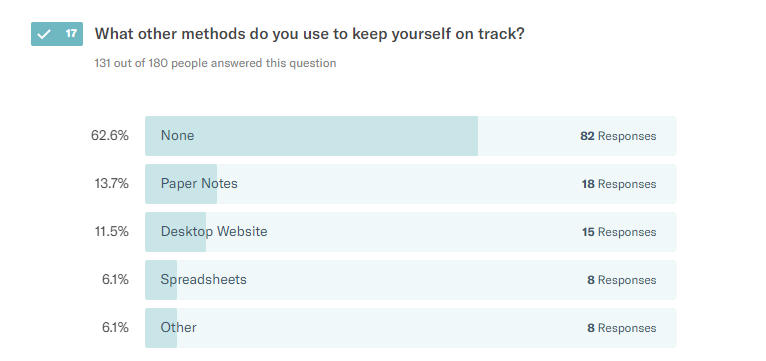

To help build the personas, the users were questioned about some habits, preferences and products that are part of their search for a healthy and fit lifestyle. It appears that 41.2% of the users of health & fitness apps do not use fitness trackers (Fig. 11) and that 68.2% don’t use social media to keep themselves motivated (Fig. 12). When asked if they use other methods to keep track of their progress, 62.6% use only the app of their choice (Fig. 13).

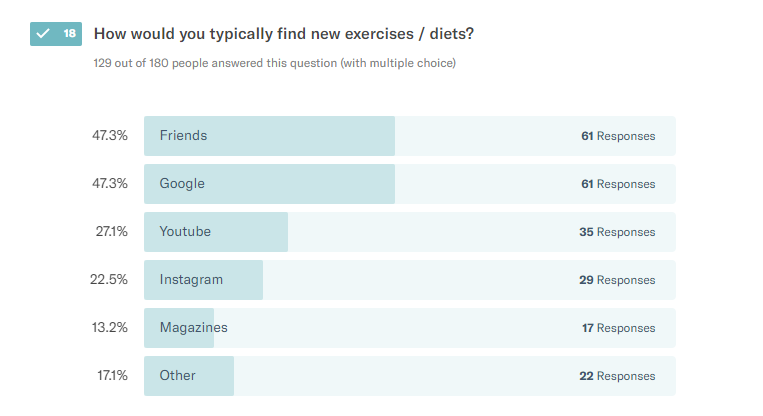

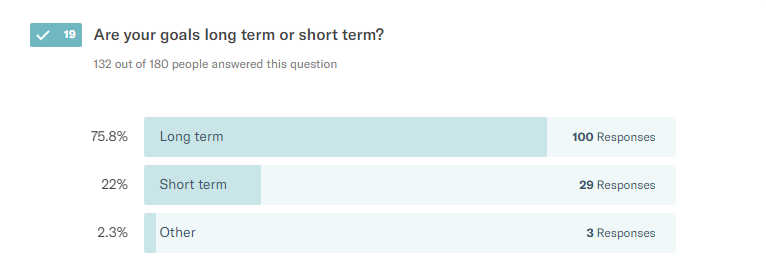

To find new exercises and diets, friends are the biggest source of information for 47.3% of the users together with Google (Fig. 14). When asked if they have long-term or short-term goals, 75.8% of the participants responded that they have long-term goals (Fig. 15).

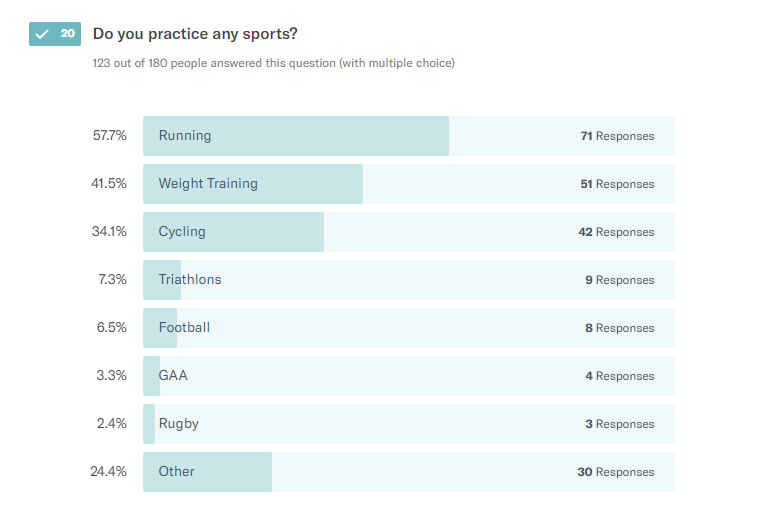

Finally, running was the most popular sports practised by the participants with 57.7%, following by weight training with 41.5% and cycling with 34.1%. Football, GAA and rugby came at the bottom (Fig. 16).

A total of 26.3% of the participants do not use any health and fitness apps. They were asked three open questions about their reasons: it appears the majority of the participants who do not use health & fitness apps have no interest or feel no need to use it. When asked if there were any feature they would like in the apps, a recurring answer was to have something easy to use, and that could also educate them about macronutrients. Finally, when asked about why did they delete apps that they previously installed, the majority had never installed any health and fitness apps.

The quantitative research gave indications as to who were the users necessary for the qualitative study and also indicated that MyFitnessPal is the application the team was going to focus.